icare NSW premium update - effective 30th june 2022

Following a recent review by the NSW State Government, iCare can confirm that NSW workers compensation premiums will increase on policies due for renewal from 30th June 2022 onwards. This modest increase aims to balance the cost impacts faced by NSW businesses as a result of recent natural disasters, COVID-19 and other global inflationary pressures.

What this increase means for you:

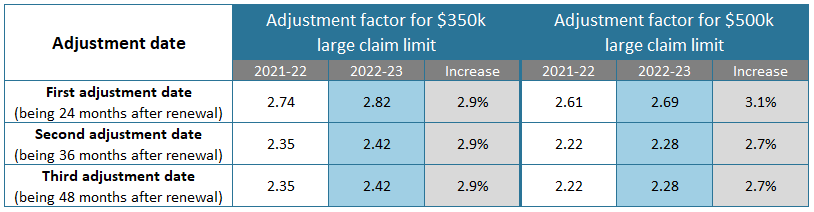

- It can be expected that 50% of rates will not change, with the other 50% increasing by an average of 2.9%;

- Monthly installments will be available to anyone with an average performance premium of over $1,000.00;

- Late payment fee has been set at 0.647% for any overdue debts.

iCare has confirmed that the LPR adjustment factors will also increase for the period 30/06/2022 – 30/06/2023 as outlined in the table below:

While these increases will impact most, Minister for Finance Damien Tudehope, has stated that NSW businesses with a strong safety record will continue to be rewarded with discounts and incentives.

If you would like more information on any of the above, then please contact your account executive or reach out to us on (02) 9587 3500, or at theteam@wsib.com.au